Effective from 10 November 2023, Azerbaijani Law on Payment Systems and Payment Services (" the Law"), the first law regulating payment services, payment systems, electron money and overall, payment gateways in Azerbaijan enters into force.

Effective from 10 November 2023, Azerbaijani Law on Payment Systems and Payment Services (" the Law"), the first law regulating payment services, payment systems, electron money and overall, payment gateways in Azerbaijan enters into force.

Firstly, the Payment Systems and Services Law regulates payment services. The following are considered payment services:

Payment service organizations are considered payment providers.

The following are payment service providers:

- Central Bank of Republic of Azerbaijan

- Banks and local branches of foreign banks

- Non-bank credit organizations operating in accordance with the Law of the Republic of Azerbaijan “About non-bank financial institutions”

- National postal operator of postal communication

- Payment providers

- E-money providers

Moreover, several requirements are defined for the payment providers, e-money providers and operator.

Since this activity is included in the list of licensed activities, an appropriate license must be obtained (except for the Central Bank of the Republic of Azerbaijan).

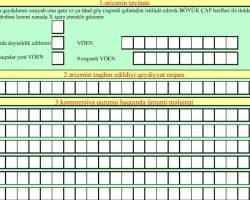

For obtaining a license, the following documents must be attached to the application addressed to the Central Bank:

- the decision of the authorized body of the legal entity;

- notarized or certified copy in accordance with Article 9 of the Law of the Republic of Azerbaijan "About Administrative Proceedings" of the charter and extract from the state register of legal entities;

- information and documents about the amount of the charter capital, the share (share) of each participant and the source of funds directed to the acquisition of the share (share);

- a document confirming that the amount of the paid-up charter capital which is not less than the minimum amount determined by the Central Bank in accordance with Article 4.2 of the Law;

- documents confirming the compliance of the owners of significant participation shares with Article 61.4 of the Law;

- information on the civil integrity of the applicant's persons performing management functions, including documents confirming that the head of the executive body meets the requirements established by Articles 60.1 and 60.3 of the Law, in the notarial or certified copy in accordance with Article 9 of the Law of the Republic of Azerbaijan "On Administrative Proceedings";

- information about the applicant's organizational structure, management bodies, relations between its participants and beneficial owners in the form determined by the Central Bank of the Republic of Azerbaijan, including their civil integrity as defined by the Law;

- activity program for the payment service to be provided and business plan for the first 3 (three) years;

- information on the applicant's internal control and risk management system, including security measures to protect against fraud and illegal use of personal data during the provision of payment services;

- business continuity and recovery plan in case of emergency;

- procedures for recording, monitoring, tracking and restricting access to sensitive payment information.

It should be noted that the requirements for the minimum authorized capital and the minimum amount of the total capital of the payment providers and e-money providers, the procedure for calculating the total capital, as well as the structure and composition are determined by the normative acts of the Central Bank. These rules will be adopted.

In addition to providing payment services, a payment providers and e-money providers may perform the following activities:

- currency exchange activity in accordance with the procedure determined by the Central Bank for the execution of payment orders (except for payment organizations that provide payment services specified in Articles 3.1.6 and (or) 3.1.7 of the Law);

- providing loans to payment service users under conditions agreed with them in the manner and within the requirements established by the Central Bank for conducting payment operations defined by Article 3.1.2 of the Law;

- providing loans to payment service users under conditions agreed with them in the manner and within the requirements established by the Central Bank for conducting payment operations defined by Article 3.1.2 of the Law;

- operator activity on the basis of a license obtained in accordance with the Law, as well as other activities that the operator can perform in accordance with Article 43.6 of the Law;

- organization of trainings and consulting services related to payment services, as well as software development.

The right to open a payment account for legal entities and individual entrepreneurs is given to banks, non-bank credit organizations (regarding the obtained loan), as well as the national operator of postal communication, as well as the e-money provider for the first time.

The Law defines e-money, as well as the rules and conditions of its issuance.

Electronic money is given the following definition: a payment instrument that is available to the user of the payment service in the amount of accepted funds, is stored in electronic form, allows the implementation of payment transactions and is accepted for payment by third parties as well as the issuer of electronic money.

The currency of the issued electronic money, the maximum amount and the maximum amount of liabilities for the electronic money issued by an issuer are determined by the normative acts of the Central Bank of the Republic of Azerbaijan.

Electronic money can be obtained by a legal entity, a local branch of a foreign legal entity, and an individual entrepreneur only by transferring it to the issuer from the payment accounts belonging to those entities.

The Law also sets out extensive requirements, conditions and regulations related to the mentioned topics, especially regarding payment services and electronic money.

If you have any further questions about payment systems, payment service providers, electronic money operations, you can contact us via:

office@caspianlegalcenter.az ; +994 50 289 89 73

Updates on the Registry Information of Legal Entities explained in this article.

Below we list and explain recently adopted rules and executive regulations under the Azerbaijani ...