Updates on the Registry Information of Legal Entities explained in this article.

Some amendments and additions have been made to the Tax Code of the Republic of Azerbaijan and the Law of the Republic of Azerbaijan "On State Registration and State Registry of Legal Entities." The amendments entered into force on July 21, 2025.The amendments are explained in detail below.

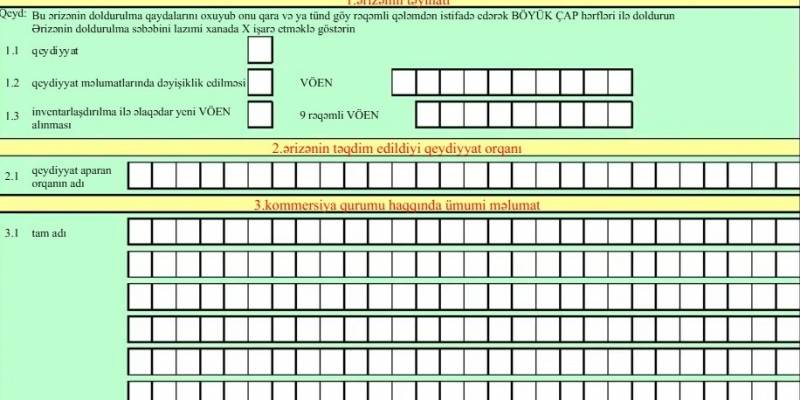

For the registration of changes in the state registry, legal entities must file an application to the relevant registration authority of the Republic of Azerbaijan no later than 15 business days from the moment changes occur (previously this period was set at 40 business days).

According to Article 9-2.1 titled "State Registration of Legal Entity Being in Bankruptcy Proceedings," added to the Law "On State Registration and State Registry of Legal Entities," the fact that a legal entity is in bankruptcy proceedings must be registered with the state. Information regarding this matter must be submitted to the relevant authority with an application no later than 15 business days after the commencement of bankruptcy proceedings.

For this purpose, the aforementioned "15-day" period is calculated from the date of adoption of the debtor's decision on commencement of bankruptcy proceedings when bankruptcy proceedings commence without the involvement of the court. When bankruptcy proceedings commence through court procedure, the period is calculated from the date of acceptance of the debtor's application by the court or from the date when the court decision on declaring the debtor bankrupt based on a creditor's application enters into legal force. As in analogous cases, such changes are registered within 5 business days when legally compliant documents are submitted.

Furthermore, according to the amendment made to Article 12.8.1 of the aforementioned Law, information related to the legal entity being in bankruptcy proceedings will be reflected in the state registry. The requirement for the phrase "in bankruptcy proceedings" to be reflected on the legal entity's seal has also been established as a new requirement.

When a legal entity is liquidated as a result of bankruptcy, the property administrator must submit the prescribed documents to the authority (institution) designated by the relevant executive authority, together with a certificated from the Central Bank of the Republic of Azerbaijan in regards to joint-stock companies, along with a seal inscribed "in bankruptcy proceedings," within 10 days after the court decision on liquidation of the entity enters into legal force.

Simultaneously, based on amendments made to tax legislation, an individual engaged in entrepreneurial activity without creating a legal entity must notify the tax authority within 15 days from the moment of being declared bankrupt and from the date of termination of bankruptcy proceedings.

Amendments to the Azerbaijani laws regarding the beneficial ownership information entered into f...

Currency control and foreign-exchange regulations are simplified in Azerbaijan. The amendments pr...

Update on the practice of authorized capital increase in Azerbaijan

-250x200.jpg)